Executive summary

The size of the Indian

consumer market is poised to reach $ 4 trillion by 2025.

It could be seen that

population drawing income between INR 500,000 and INR 20,00,0000 (i.e. Aspirers

and Affluent, in the above classification) is growing at faster rate than any

other segment in the above analysis. Together they are expected to make up 45%

of the total consumption expenditure in India in 2025. (Boston Consulting Group 2017) This strong domestic

consumer base is the strength of the Indian economy. This strong consumer base

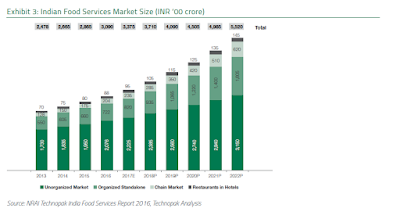

is what makes India a favorite destination for FDI. Indian Food Services market

in India (organized and unorganized) is estimated at INR 3,37,500 crore in 2017

and is projected to grow at a CAGR of 10% over the next 5 years to reach INR

5,52,000 crore by 2022. (Technopak 2017)

Over the years the market

size of the restaurant chains in the food industry has been growing.

Year

|

2013

|

2014

|

2015

|

2016

|

2017

|

Market size

|

128

|

150

|

175

|

204

|

235

|

(Rs. In ‘00 Crores)

|

|||||

CAGR

(Computed)

|

17.18%

|

16.67%

|

16.57%

|

15.19%

|

As it can be seen, the

market for the restaurant chains has grown at a steady rate. Therefore, the

sector as a whole is promising in terms of consumer demand.

However the supply side

economics should also be considered. Given the unpredictability of daily

demand, there is always the risk of wastage of production on daily basis. On

the other hand, not meeting the consumer demand would impinge badly in the

minds of the customers. Hence, it is crucial to strike a balance between excess

production and short production.

Much of the solution to this

problem lies in garnering a reliable consumer base. A regular and predictable

demand for the food would help the firms to produce enough to meet the

requirement.

This reliable demand base,

in turn could be formed, only through offering food at cost effective rates.

The highest share of consumption expenditure in Indian market comes from

people, whose annual income is between INR 150,000 and INR 500,000. They alone

account for 38% of the total consumption expenditure in India as at 2016.

If the sector could come up

with innovative cost effective business models that could cater to the later

consumer segment, the prospects for this sector is very bright.

1. Sector size, Composition and

Constituents

Major Players

b)

McDonald's

The following factors affect the growth of the

restaurant industry

a)

Increasing varieties

The ever increasing culinary

recipes make dining an important experience of respite and relief.

b)

Growing mobility of restaurant services

In the recent years food delivery

service providers like Swiggy, Ubereats, Eat24 have made dining easier.

c)

Amenities

Customer’s experience at the

restaurant apart from eating influence the customer demand. More the amenities,

more the restaurant would be appealing to customers.

d)

Demographics

Almost 45% of the population is

less than 24 years. The young demographic population of the country serves as

the prime market for these restaurants.

e)

Increasing Urbanization

About 34% of India's population

now lives in urban areas, the U.N. World Urbanization Prospects 2018 report has

said. This is an increase of about three percentage points since the 2011

Census. The increasing urbanization is a promising factor for the industry to

grow as these restaurants operate in urban cities primarily.

f)

Increasing women labor

It is expected that women

employees in service sector would increase from 20% in 2011 to 25% 2020. (Technopak

2017) With more

women entering the working population, cooking at home has decreased. This in

turn has increased the demand for food at restaurants.

g)

Nuclear families

About 68% of the Indian families

are nuclear families. It is expected to grow to 75% by 2025. Nuclear families

tend to diverge from conventional practices of avoiding outside foods. With

increasing number of nuclear families, the restaurant business could see better

prospects in their way.

3. Value

chain of the sector and various business models

a) Primary activities

·

Deciding the menu for

service

·

Cooking

·

Service of the food

b) Support activities

·

Sourcing of the

ingredients

·

Dining experience

provided

·

Provision of other

amenities like TV, Lounge etc..

·

Marketing

·

Delivery services

The above classification of

primary and secondary activities has become more of a theoretical exercise,

given the competition in the industry. In order to be successful, a firm has to

provide rich experience to its customers in each of the aforesaid fronts.

4. Various

business models

5. Cost and Revenue drivers

a) Considerations for Cost

·

Cost

of the ingredient products

·

Cost

of skilled and unskilled labor

·

Rental

cost

b) Revenue drivers

·

Quality

of the food served

·

Cost

effectiveness

·

Other

Amenities offered at the restaurant

6.Risks specific to the sector

a) Skyrocketing rental costs

With the increasing real estate costs, expansion for the

restaurant chains has become a great deal.

b) Too much concentration in the metro cities

With almost all the restaurant chains focusing on capturing

the market in metro cities, there is too much strain on the markets in the

urban cities. This mutually affects the profitability of the market

participants at urban centers.

c) Risk of losing the brand value

Any action that could affect the credibility of the

restaurant at one place could affect the restaurant chain as a whole. This is

perhaps, the single most deterring risk factor that the market players need to

be wary of.

Eg: Recently central kitchen of a famous restaurant chain

was sealed for unhygienic practices by the regulators. This has led to the

restaurant chain losing competitive edge and credibility in the public arena.

7.Funding overview of the sector

|

Company

|

Debt to equity *

|

Market capitalisation**

|

Product

|

|

Westlife

development

|

0.30

|

5,477.02

|

1,643.11

|

|

Jubilant

Foodworks

|

-

|

16,409.13

|

-

|

|

Total

|

|

21,886.15

|

1,643.11

|

|

Net Debt to Equity Ratio

|

|

|

0.08

|

*Debt to equity ratio is derived from the 2nd quarter financial results of the companies for the FY 2018-19.

**Market capitalization is in Crores as at 09th

December 2018.

Westlife

development and Jubilant Foodworks, who are considered to be representative of the sector, have been

taken as proxies for the computation of the debt to equity ratio. As it can be

seen, the sector is least funded by debt and is operating primarily on its own

capital.

8.Key

performance metrics at firm level and sector level

Firm level

·

Number of

customers visits per day

·

Average

revenue per customer

·

Number

of repeat visits of a customer per year

Sector level

·

Number

of new restaurants opened in the country during a particular period

·

Contribution

of the sector to the national GDP

·

Revenue

growth of the sector Y-o-Y and Q-o-Q

8. Summary

of industry level financial performance

The chain

market is expected to grow at a CAGR of 21% to reach INR 62,000 crore by 2022

from INR 23,500 crore in 2017.The market size was at the tune of INR 20400

Crores as at 2016 and the projected market size for 2018 was INR 28,500 Crores.

9. List of

key players in the sector