Tried to snip the key-take-aways from the book authored by "Rayner Teo" on Price action trading

What are Impulsive and Corrective moves ?

Next, the author discusses four key technicalities to look gauge the trend and its strength

I found the following mention to be trivial. But the lead the Rising three method gives is what that causes me to mention this here.

Variation of rising three method- Penants, Flags- a forerunner to a breakout

To throw more light on the penants and flags, quoting from here

- Bullish Penant

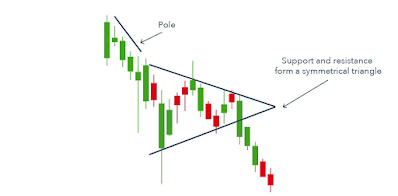

To identify a bullish pennant, you’ll need to watch for two elements. Firstly, a pronounced upward movement beforehand known as the ‘pole’. Secondly, a price consolidation that forms a roughly symmetrical triangle with its support and resistance lines.

- Bearish Penant

To identify a bearish pennant, look for a consolidation between support and resistance after a major bearish price move (the pole). The support and resistance lines will form a roughly symmetrical triangle, showing that the market is in conflict between positive and negative sentiment.

- Other similar patterns

The following readings would give a deeper understanding of the commonly observeable patterns

Disclaimer

The above excerpts are based on my understanding of important mentionings in the book and are not exhaustive.

No comments:

Post a Comment